Georgia Legal Guide: How You Can Stack Insurance After A Car Accident To Maximize Your Recovery

Key Points:

- “Stacking” determines the order of payment. When multiple insurance policies apply to the same accident, Georgia law establishes a priority system to determine which insurance company pays first.

- “Insurance follows the car” is the general rule. The insurance policy covering the vehicle involved in the accident typically pays first, regardless of who was driving.

- Some policies can be stacked for additional coverage. In certain situations, policyholders may access multiple insurance policies to fully cover their damages.

- Contract language can modify stacking rules. Insurance companies may write policies that alter the standard stacking order but cannot override Georgia law.

In car accidents involving borrowed vehicles or underinsured drivers, stacking insurance policies can be the key to maximizing recovery. Georgia law allows stacking in many cases, but rules about which insurance company pays first and how much can be complicated.

What Does “Stacking” Mean In Auto Insurance?

Think of insurance stacking like building blocks. When multiple insurance policies could apply to the same accident, Georgia law establishes a priority system, often referred to as a “stack,” which determines which insurance company pays first, second, and so on. The primary insurance policy forms the foundation, and other policies are stacked on top, paying in sequence until either your damages are fully compensated or all the available coverage is exhausted.

Stacking can be crucial because it can mean the difference between partial compensation and full recovery for your injuries.

Georgia’s Key Insurance Stacking Rule: Insurance Follows the Car

Under Georgia law, the general rule is that liability insurance “follows the car.” This means the insurance policy covering the vehicle involved in the accident often pays first, depending on whether the claim is a liability claim or a UM claim, regardless of who was driving. Any other applicable insurance policies, such as the driver’s personal coverage, usually provide secondary or excess coverage.

However, Georgia law includes several important exceptions to this rule, and insurance companies can also modify the stacking order through specific contract terms.

Example: Veronica’s Accident

Veronica borrowed her brother Malcolm’s pickup truck to help her daughter move into her college dormitory. While driving through downtown Fairburn, Veronica was rear-ended by Desmond, who ran a red light. The collision pushed Veronica’s truck into the vehicle ahead, injuring both Veronica and the driver of that vehicle, Celeste.

Here’s how the stacking of insurance policies works in this scenario.

Veronica’s injuries totaled $100,000:

- Desmond has $50,000 in liability (bodily injury) insurance (primary payer)

- Malcolm’s truck insurance provided $25,000 in un-insured (UM) motorist coverage (secondary payer for Veronica)

- Veronica’s personal auto insurance offered $25,000 in UM insurance (next payer)

- Total available coverage: $100,000 for Veronica’s injuries

Celeste’s injuries totaled $120,000:

- Desmond’s liability coverage provided $50,000 (primary payer)

- Celeste has two underinsured motorist coverage policies on two separate vehicles, each providing $50,000 in UM coverage, which can be stacked to a total of $100,000 (secondary payer)

- Total available coverage: $150,000, covering Celeste’s injuries.

Key insight: Without stacking, Veronica would have been limited to the $50,000 liability coverage from Desmond and $25,000 from her UM policy, leaving $25,000 of her injuries uncompensated and Celeste would be limited to just $100,000 in coverage, also leaving a shortfall.

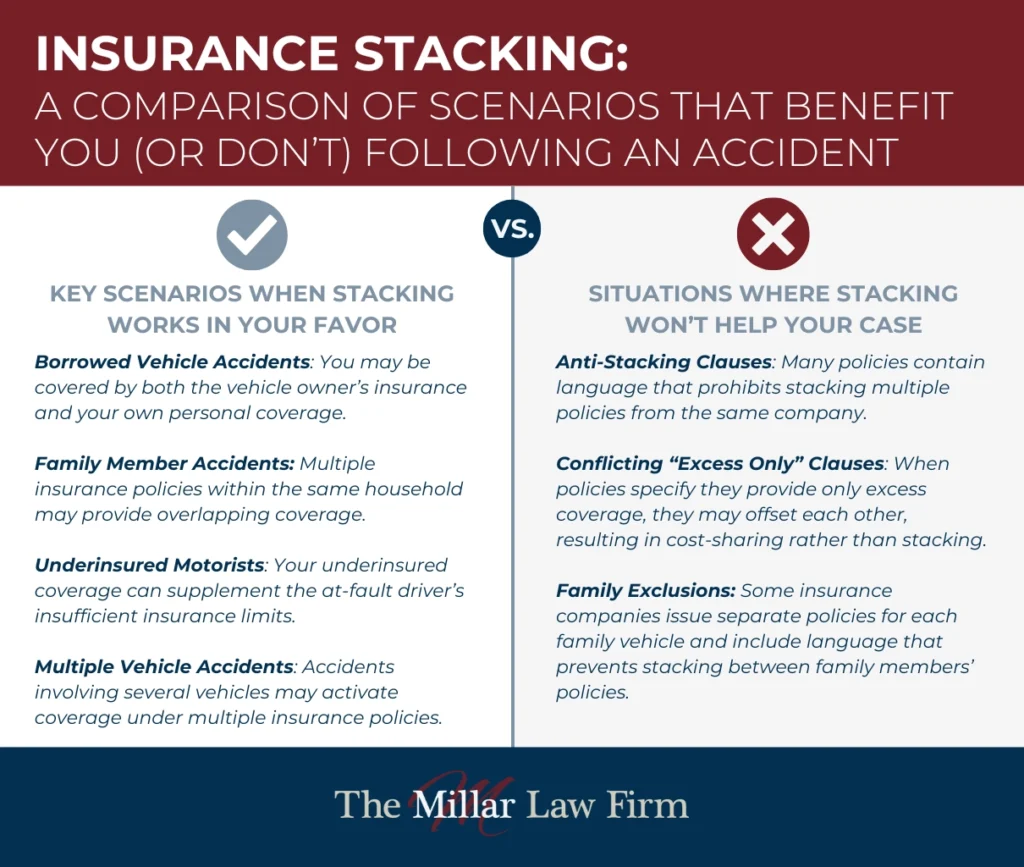

When Stacking Works In Your Favor

Stacking can significantly increase your recovery in several situations, including:

- Borrowed vehicle accidents: When driving a vehicle owned by someone else, you may be covered by both their insurance and your own personal coverage.

- Family member accidents: Multiple insurance policies within the same household may provide overlapping coverage, though some insurance companies try to limit this.

- Underinsured motorist situations: Your underinsured coverage can supplement the at-fault driver’s insufficient insurance limits.

- Multiple vehicle accidents: Complex accidents involving several vehicles may activate coverage under multiple insurance policies.

Situations Where Stacking May Not Help

Insurance companies often include provisions that limit stacking in certain situations, such as:

- Anti-stacking clauses: Many policies contain language that prohibits stacking multiple policies from the same company.

- Conflicting “excess only” clauses: When two policies both specify that they provide only excess coverage, they may offset each other, resulting in cost-sharing rather than stacking.

- Family exclusions: Some insurance companies issue separate policies for each family vehicle and include language that prevents stacking between family members’ policies.

What Stacking Means For Your Accident Case And What To Do Next

Understanding stacking rules can significantly impact the outcome of your claim and the compensation you receive. To protect yourself, consider the following steps:

- Identify all applicable policies: Don’t assume coverage is limited to a single insurance policy. Identify coverage on all vehicles involved, personal policies of all drivers, and any umbrella policies.

- Obtain and review all insurance contracts: The specific terms and conditions in insurance contracts can affect your ability to stack insurance. In some cases, contracts can override Georgia’s general stacking rules.

- Notify insurance companies promptly: It’s important to contact each relevant insurance company as soon as possible to preserve your ability to stack coverage.

- Document relationships and circumstances: Record details about who owns each vehicle, who was driving and why, and any relevant family relationships, as these may affect coverage.

- Don’t rush to settle: Before accepting a “final” settlement offer, make sure all available sources of coverage have been identified and considered.

- Consult an experienced attorney: Stacking cases can involve complex legal and contractual issues. An attorney can help maximize your recovery

Insurance companies can modify stacking rules through contract provisions, but they cannot violate Georgia’s public policy or statutory requirements. If a policy attempts to eliminate coverage that Georgia law requires, those provisions may be deemed void and unenforceable.

When both policies contain “excess only” clauses that conflict with each other, Georgia courts typically rule that these provisions cancel each other out. Instead of stacking, each insurance company pays a proportional share based on its respective policy limits. This was affirmed in State Farm Fire & Casualty Co. v. Holton (1974).

This depends on how the insurance company structures its policies. Mutual insurance companies often issue separate policies for each family vehicle and include anti-stacking language. In contrast, stock companies typically issue one policy covering multiple vehicles but limit total coverage per accident.

No. Georgia applies different rules depending on the type of coverage. While liability coverage typically follows the vehicle, uninsured and underinsured motorist coverage follows a different rule where the insurer that received premiums from the injured party pays first, regardless of which vehicle was involved.

Under Georgia law (O.C.G.A. § 33-36-14), if a primary insurer becomes insolvent, any available solvent insurance coverage automatically becomes primary. The Georgia Insurers Insolvency Pool may provide backup coverage, but only after other solvent coverage is exhausted.

Sometimes yes, sometimes no. If you have multiple vehicles and each vehicle has its own policy, stacking may be possible. However, some insurance companies issue one policy covering multiple vehicles and such policies typically contain anti-stacking language stating that liability limits are per accident, not per vehicle, as seen in Smith v. Allstate Insurance Company (2004). When you are involved in an accident it is usually a good idea to have an expert in this area of the law, such as a personal injury lawyer, review your accident for all potential sources of insurance and stacking.

You should identify and notify all potential insurance companies as soon as possible after an accident. While Georgia’s statute of limitations gives you two years to file a lawsuit, many insurance policies require prompt notice of claims, and delays can jeopardize your coverage.

If an insurance company wrongfully denies secondary or excess coverage required under Georgia law, it may be liable for bad faith. If this occurs, you should contact an attorney immediately. Insurance companies are not permitted to disregard their obligations to provide excess coverage when their policy is properly stacked under Georgia law.