What to Know About Georgia’s Auto Insurance Coverage Requirements

Key Points

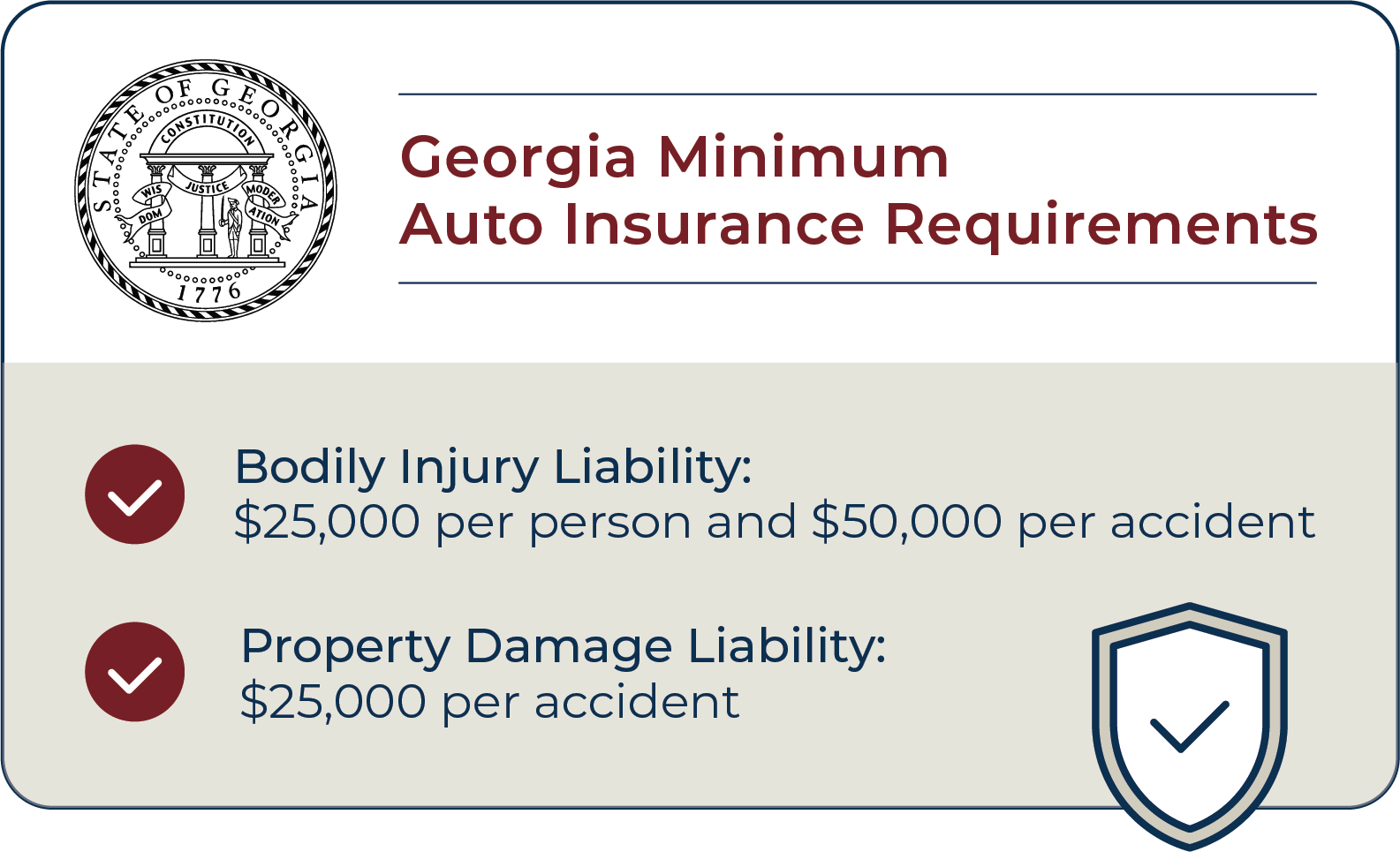

- Georgia drivers must maintain minimum liability insurance coverage that includes $25,000 for bodily injury per person, $50,000 for bodily injury per accident, and $25,000 for property damage per accident.

- Uninsured/underinsured motorist coverage offers you protection if you’re involved in an accident with a driver who either doesn’t have insurance or whose insurance is insufficient to cover the damages.

- For extra protection, you can add additional coverages to your auto insurance policy.

Table of Contents

Accidents can be costly. In Atlanta, residents depend on the insurance of the at-fault driver to cover these costs. In most cases, the damages from an accident don't exceed the available insurance coverage and the insurance company will acknowledge their driver’s liability and compensate you for your damages.

However, sometimes the available insurance coverage falls short of the needed amount. This leaves the victims stuck dealing with out-of-pocket expenses when the policy limits are exhausted.

Auto Insurance Requirements Facts and FAQs

Do I Need Auto Insurance in Georgia?

Yes, all owners of motor vehicles registered in Georgia must have liability insurance coverage to legally operate their vehicles on public roads. This helps to ensure financial responsibility in the event of an accident that results in bodily injury or property damage.

What are the Minimum Auto Insurance Requirements?

The minimum requirements for auto insurance in Georgia are as follows:

- $25,000 for bodily injury liability per person

- $50,000 for bodily injury liability per accident

- $25,000 for property damage liability per accident

While these are the minimums, drivers often choose higher limits to give themselves more security.

What Are the Penalties for Drivers Who Do Not Meet State Insurance Requirements?

If caught driving without the required amount of insurance, drivers may incur fines, face license suspension, and have their vehicle registration suspended. Repeat offenders can face harsher penalties, such as higher fines and longer suspension periods. If an uninsured or underinsured driver is involved in an accident, they can be held liable for damages and injuries that exceed their coverage. This shows the importance of maintaining proper insurance coverage as required by state law.

How Are Auto Insurance Laws Enforced?

In Georgia, auto insurance requirements are enforced through a combination of state systems and law enforcement actions. The Georgia Electronic Insurance Compliance System (GEICS) allows for real-time electronic monitoring of insurance coverage, which is checked when vehicles are registered or registration is renewed. If insurance lapses or is canceled, the Georgia Department of Revenue is notified, leading to potential fines, registration suspension, or driver's license suspension. Additionally, law enforcement officers enforce insurance compliance during traffic stops or at accident scenes by requesting proof of insurance. If a driver fails to provide valid insurance, officers can verify their status via GEICS, and issue citations and fines. This comprehensive approach ensures drivers maintain the legally required insurance coverage.

Bodily Injury Liability Coverage

Bodily injury liability coverage is one of the most crucial components of an insurance policy. As the name suggests, it specifically provides coverage for injuries sustained by drivers and passengers involved in an accident. This coverage helps ensure that the medical expenses and related costs are managed, protecting the insured from severe financial burdens in the event of an accident.

What are the Minimum Auto Insurance Requirements for Bodily Injury Liability Coverage?

In Georgia, the minimum auto insurance requirements for bodily injury liability coverage are designed to offer a fundamental level of financial protection in accidents for which the policyholder is at fault. The state mandates that each driver carry at least $25,000 in coverage for bodily injury per person and $50,000 per accident. This means that in the event of an accident, the policy will cover up to $25,000 for each person injured and a total of $50,000 for all injuries incurred in that single incident. These limits help cover medical expenses and other related costs, although many drivers choose to purchase higher limits to secure additional protection against potential claims.

What Expenses are Typically Covered Under Bodily Liability Coverage?

These expenses may include medical bills, hospital costs, rehabilitation expenses, and even lost wages if the injured parties can't work because of their injuries. This coverage can also cover pain and suffering endured by the injured parties, legal fees, and settlements. By covering these various expenses, bodily injury liability coverage offers protection for both the insured driver and others involved in the accident.

What Are the Exclusions or Limitations in Bodily Injury Liability Policies?

While bodily injury liability coverage is important for safeguarding drivers from financial fallout in accidents, it's worth noting some common restrictions and limits in these policies. One typical exclusion is intentional acts, meaning injuries caused deliberately by the insured driver aren't usually covered. Also, bodily injury coverage might not apply to injuries suffered by the insured driver or their listed family members. Coverage amounts have limits too, meaning the policy only pays up to a certain amount, and any costs beyond that fall on the insured. It's essential for drivers to carefully read their policy documents to understand these exclusions and limits.

How Does One Go About Making a Bodily Injury Claim?

To make a bodily injury claim, start by seeking medical help after an accident. Then, inform your insurance company promptly about the accident, providing all relevant details like when and where it happened, as well as names of people involved. The insurance company will investigate and may ask for proof such as medical records and photos. Based on your policy and their findings, they'll decide how much to pay you. If you're not satisfied with their offer, you can try negotiating or seek legal help by contacting a car accident lawyer in Atlanta.

Should an Accident Victim hire a Car Accident Lawyer to get Compensation for a Bodily Injury Claim?

Absolutely. Auto insurance companies often miscalculate medical expenses, which are central to bodily injury compensation. If you have medical bills, it's likely you've also endured pain and suffering, costs that insurers frequently overlook. A car accident lawyer can help you pursue greater compensation by leveraging bodily injury liability coverage to cover these expenses more effectively.

Property Damage Liability Coverage

Another essential coverage required for Atlanta drivers in Georgia is property damage liability coverage. In Georgia, drivers must have both bodily injury and property damage coverage as part of their insurance requirements.

What is Property Damage Liability Coverage?

Like bodily injury coverage, property damage coverage is self-explanatory. It is specifically designed to cover the costs associated with damage to vehicles or other property resulting from an accident. This type of insurance ensures that the policyholder is not financially burdened by the expenses of repairing or replacing property damaged in a collision.

What is the Minimum Requirement Needed in Property Damage Liability Coverage?

In Georgia, the minimum requirement for Property Damage Liability (PDL) coverage is $25,000. This means that drivers in Georgia must carry at least this amount in insurance to cover damages to another person's property in the event of an accident for which they are at fault. It's important to note that this is just the legal minimum, and it may be advisable to carry higher limits to ensure more comprehensive financial protection against potential damages from significant accidents. Always check with your insurance provider or Georgia's Department of Driver Services for the most current information and to discuss your specific insurance needs.

Does Property Damage Liability Cover My Own Vehicle if I'm At Fault?

Property Damage Liability (PDL) insurance does not cover damages to your own vehicle if you are at fault in an accident. This type of insurance is designed to cover the costs of damage to another person's property—including their vehicle—resulting from an accident for which you are responsible. To cover damages to your own vehicle in an at-fault accident, you would need collision insurance, which is a separate coverage.

Do Auto Insurance Companies Partner with Body Shops to Reduce Property Damage Liability Costs?

Yes, many auto insurance companies partner with body shops to manage Property Damage Liability costs. These partnerships allow insurers to negotiate lower rates for repair work, which can help keep insurance premiums more affordable for policyholders. By using a network of approved body shops, insurance companies can also ensure quality and efficiency in the repair process.

Are Lawyers Needed for a Property Damage Liability Claim?

Auto insurance companies typically accurately assess the cost of property damages, often with assistance from collision centers. Personal injury lawyers, who often specialize in car accidents, primarily focus on bodily injuries. These lawyers work to ensure that victims receive fair compensation for medical expenses, pain, suffering, and other related costs that may not be adequately covered by insurance.

Other Auto Insurance Requirements by the State of Georgia

What is UM and Why is it Required by the State of Georgia for All Drivers?

In Georgia, the requirement for Uninsured Motorist (UM) coverage is outlined in the Official Code of Georgia Annotated (OCGA) under Title 33, Insurance, specifically Section 33-7-11. This section of the Georgia insurance law mandates that all automobile liability policies issued in the state must include Uninsured Motorist coverage unless the policyholder specifically rejects this coverage in writing. This provision ensures that drivers have the opportunity to be covered against losses caused by uninsured or underinsured drivers.

Is it Against the Law in Georgia to Not Have UM Insurance Coverage?

No, it is not against the law in Georgia to not have Uninsured Motorist (UM) insurance coverage. In Georgia, while auto insurance policies are required by law to offer UM coverage, policyholders have the option to reject this coverage in writing. This means that drivers can legally choose not to have UM coverage as part of their auto insurance policy. However, having UM coverage is generally recommended as it provides additional financial protection in accidents involving uninsured or underinsured drivers.

Do Most Atlanta Drivers Have UM?

There's no specific data on how many Atlanta drivers carry Uninsured Motorist (UM) coverage, but since opting out requires a written rejection, it's common for those with auto insurance to have it. However, it's essential to confirm with your insurance agent rather than assume you're covered. Lacking UM coverage can lead to substantial financial losses if you're involved in an accident with an uninsured or underinsured driver.

1201 West Peachtree Street #2339 Atlanta, GA 30309+1-770-212-3795$0-$100000

1201 West Peachtree Street #2339 Atlanta, GA 30309+1-770-212-3795$0-$100000Besides the exceptional service I have been receiving thus far, they sent me a card for my birthday! Such a class act and made for the best surprise! Thank you so much Millar Law Firm for the thoughtful gift!

What Auto Insurance Coverage a Personal Injury Lawyer Recommends In Georgia

Carrying more insurance coverage than what is required provides several benefits, including more financial protection. This is important in accidents with uninsured drivers or in the event of a hit-and-run. Additional coverage can protect you financially and give you peace of mind.

Do Personal Injury Lawyers Recommend More UM or UIM Insurance Coverage?

Georgia’s minimum insurance requirements have not kept pace with the rising costs of auto accidents. If you’re involved in an accident with a driver who only carries the minimum required insurance, you may have to rely on your underinsured motorist (UIM) coverage to cover the additional expenses. Without it, you could end up paying out of pocket. It’s always wise to carry additional UM or UIM coverage.

What is Personal Injury Protection and Why is it Important?

Personal Injury Protection (PIP) is a type of auto insurance coverage that covers medical expenses, lost wages, and other related costs regardless of who is at fault in an accident. It's often referred to as "no-fault" coverage because it pays out claims irrespective of fault determination.

Car accident lawyers encourage clients to have PIP because it ensures that medical treatment and other necessary expenses are quickly covered without the need to establish fault. This can be crucial in helping accident victims recover without the additional stress of financial strain. PIP can also cover other expenses such as rehabilitation services, funeral costs, and loss of services, which can be vital for a comprehensive recovery process. By having PIP, individuals gain an added layer of financial protection that helps them focus on recovery after an accident.

Do Personal Injury Attorneys Recommend Having Higher Policy Limits for all Types of Coverage?

Personal injury lawyers often have stories of people who suffered life-altering injuries but didn't have enough insurance coverage to handle the costs associated with their accidents. While higher coverage limits lead to higher premiums, it's often better to pay now than to have to pay later. The last thing any accident victim wants to discover is that they don’t have enough insurance to cover the expenses of a serious accident.