What To Do When Injured By A Driver With Expired Insurance: Georgia Legal Guide

If you’ve been in a car accident, you know that the first thing you do is trade insurance information with the other driver. Since Georgia is an “at-fault” state for auto insurance, your next step is filing a claim with the other driver’s insurance company. Then you wait for the company to process your claim.

For most claims, the process results in the at-fault driver’s insurance company eventually paying the claim. But what happens when the other driver’s insurance has expired or been suspended for non-payment? What should you do if you’re left facing a stack of bills and after being hit by a driver with no insurance?

This situation happens more often than people think. Before you give up all hope, Georgia law gives you some potential options when you are left holding the bills due to another driver’s lack of car insurance.

First: Get a Car Accident Attorney to Evaluate if the Auto Insurance Company Followed Georgia Laws

If your claim is denied due to another driver’s lack of insurance, you will want to make sure that the insurance company is being truthful and accurate:

Is the insurance company’s denial valid? Just because the at-fault driver’s insurance company tells you a policy is expired does not mean it was legally cancelled. Georgia insurance laws (O.C.G.A. § 33-24-45) require companies to follow specific procedures before they terminate a policy.

- The policy holder must have 30 days written notice of cancellation or non-renewal before the company terminates the policy.

- The company must show that the notice was received, not merely mailed.

- Georgia law provides a ten-day grace period for policy holders—they have ten days after an accident to pay any missed premiums and maintain coverage

Merely because a policy has lapsed or the policy expired does not mean the driver was not covered by law. Your attorney can request the insurance company’s records to determine if they followed proper procedures and if the policy may still be in effect.

Evaluate All of Your Legal Options to Recover Compensation

If the at-fault driver doesn’t have valid insurance, your other alternatives are limited. You should consult with your car accident attorney to determine the best course of action. Some options include:

Employer or Commercial Insurance. If the other driver was working at the time of the accident, you may have a claim against their employer. Check the police report carefully to see who owned the at-fault vehicle, if it is owned by a company or another individual there could be another insurance policy that is available against which you may make a claim.

Ridsehare Insurance: Lyft and Uber drivers are covered by liability insurance if they are using the app or are carrying passengers when they have an accident.

UM/UIM Coverage: For When You Need It

When you bought your car insurance, your agent should have offered you Uninsured/Underinsured Motorist (UM/UIM) coverage. UM/UIM coverage is designed to protect you when the other driver lacks insurance, or when their liability insurance won’t cover your claim. Insurance companies must give you the option to select UM/UIM coverage.

UM/UIM coverage will cover:

- Medical costs and expenses

- Lost wages and income

- Pain and suffering

- Property damage

UM/UIM replaces the liability insurance the other driver did not have. If you don’t have it, you should get it immediately. It protects you when you have no other options after an accident.

Hypothetical Example: How Georgia UM/UIM Coverage Made the Difference

Chantel found out how UM/UIM (uninsured/underinsured coverage) helps when she was rear-ended near the Ga Highway 78 interchange. The other driver gave her a copy of an insurance card, but the claim was denied. The company claimed the driver had let the policy lapse two weeks before the accident. Chantel had more than $40,000 in doctor’s bills and would be off work for six months. Without insurance, she would be in serious financial trouble.

Chantel’s insurance agent had urged her to purchase $100,000 in UM/UIM coverage six months previously. Once her attorney confirmed that the at-fault driver’s insurance was invalid, the UM/UIM coverage kicked in and paid her medical bills, lost wages, and her pain and suffering claim, just as it was intended to do.

Other Insurance Coverage

Optional MedPay coverage can cover some of your medical bills. If you have collision or comprehensive auto insurance, that will cover some of your vehicle damage. Other medical and property insurance should pay some of your additional bills.

Personal Injury Lawsuit. You can consider a lawsuit directly against the other driver for your injuries and damages. Your car accident attorney can tell you whether this is a feasible course to take. Some drivers may have personal assets you can attach in a legal judgment, however other drivers without auto insurance often have very few assets to help pay for your damages.

After an Accident or After a Claim Denial

If you’ve been involved in an accident and are unsure about the other driver’s insurance policy, or if your claim is denied:

- Call an attorney immediately: Insurance cancellation requirements can be complex. You need legal assistance right away.

- Report the accident to your own insurance company: There can be very short time limits for putting your own insurance company on notice of your potential UM/UIM claim. It is going to be a requirement that you put your own carrier on notice of the accident in any event. Failing to do so could result in cancellation of your own coverage – even if the accident was not your fault.

- Document everything: Make three copies of all medical records, invoices, bills, and reports, one for the insurance company, one for yourself, and one for your attorney. Keep notes of any phone calls. Always save texts and emails.

- Don’t give recorded statements: Never speak with the insurance company after you have an attorney. You should not talk to anyone without first consulting an attorney and without your attorney present.

- Get proper medical treatment: Follow all doctor’s recommendations, including any rehabilitation and time off work. This provides your attorney with a timeline of your recovery.

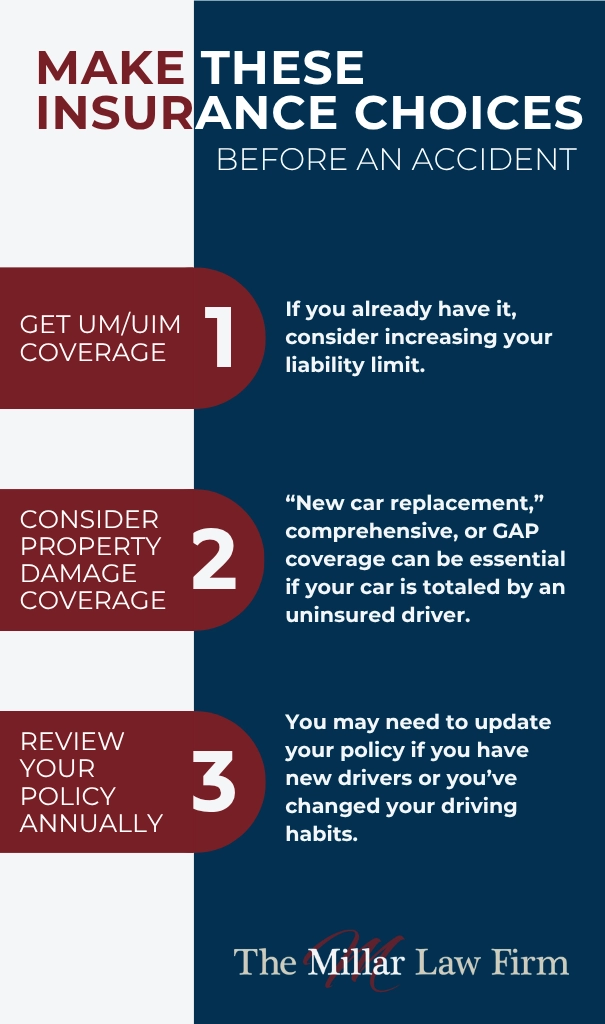

Making Insurance Choices

If you haven’t been in an accident, you still have time to make these important insurance decisions:

- Get UM/UIM coverage. If you already have it, consider increasing your liability limit.

- Consider property damage coverage. “New car replacement,” comprehensive, or GAP coverage can be essential if your car is totaled by an uninsured driver.

- Review your policy annually. You may need to update your policy if you have new drivers (such as children) or you’ve changed your driving habits (like a new job).

Never Give Up Hope

A car accident is difficult enough. Facing a driver with expired insurance is even worse. That doesn’t mean you have no options. Georgia’s insurance laws exist to protect drivers and a good attorney can help determine if there are still ways to find insurance coverage.

The insurance company may not explain all the options available. Contact a personal injury attorney as soon as possible so they can explain your alternatives and help you recover the compensation you deserve.

Yes. You owe it to yourself to demand that the insurance company produce proof that the at-fault driver’s insurance was validly canceled. If not, the insurance company may still owe coverage. Georgia law also gives the at-fault driver a grace period to pay any late premiums and keeps the policy active if the company improperly terminated it. (O.C.G.A. § 33-24-45). Additionally, in the event of no liability coverage, you can use your own UM/UIM coverage.

Under Georgia law (O.C.G.A. § 33-9-40) insurers may not increase your insurance rates if you were not at fault in an accident. UM/UIM coverage is intended to protect you for the other driver’s lack of coverage and prevents you from being penalized for using it.

Yes. Georgia’s insurance law allows you to recover special damages (medical bills and lost wages) and general damages (pain and suffering, emotional distress). All damages can be recovered through insurance claims, UM/UIM claims, or personal injury lawsuits (O.C.G.A. § 51-12-2).