Involved in a car accident? Our guide to Georgia auto insurance law and how to make a claim may be helpful after your collision.

Key Points

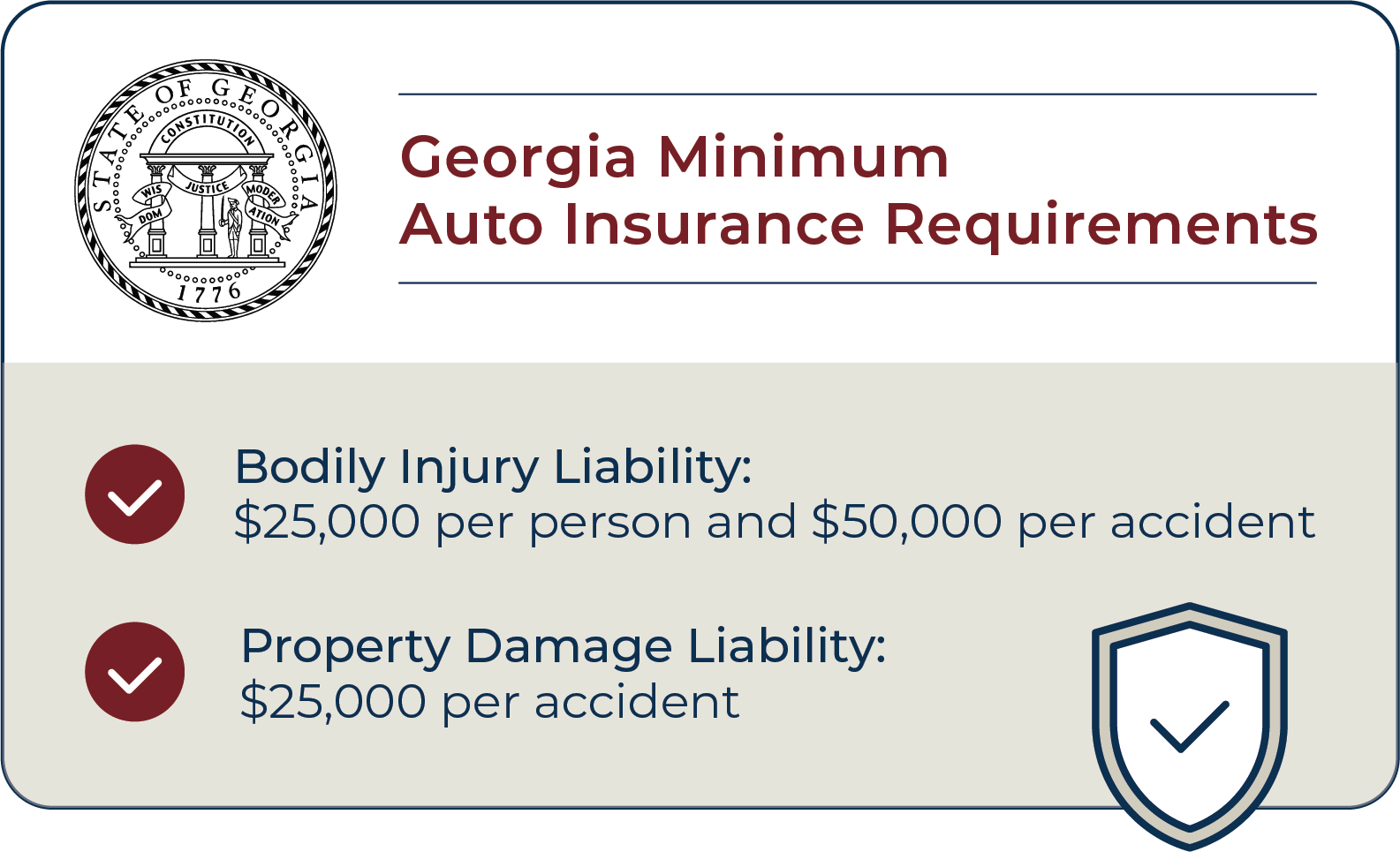

- Georgia drivers are required to carry minimum liability insurance coverage for bodily injury ($25,000 per person and $50,000 per accident) and property damage ($25,000 per accident).

- Uninsured/underinsured motorist coverage provides protection for victims of car accidents caused by drivers who don’t have auto insurance or who do not have enough insurance to cover the accident.

- Drivers can opt for additional protection by adding optional coverages to their own auto insurance policies.

There are around 400,000 car wrecks on Georgia’s roads each year. Many of these accidents result in insurance claims to compensate victims for their damages and injuries.

Unfortunately, auto insurance policies can be tricky to understand, and accident victims can leave insurance coverage on the table if they aren’t familiar with how these insurance policies work.

It’s helpful to get to know the basics of Georgia insurance coverage so that you can make sure you’re protected if you’re involved in an accident.

Who Is Covered in an Injury Accident with Your Insurance Coverage?

You might initially think that you are the only person that your insurance covers—after all, it’s your policy. In reality, though, your auto insurance provides coverage for a wide range of people if you are involved in an accident that is your fault. Depending on the types of coverage your policy includes, your own insurance policy can cover:

- Yourself;

- Passengers in your car;

- The driver of the other car or cars involved in the accident;

- Passengers of other vehicles in the accident; and

- Drivers that you allow to drive your vehicle.

You should notify your own insurance company that you have been involved in an accident. If the other driver was at-fault, then you should also contact their insurance company for the repair of your vehicle.

If a medical provider agrees to treat your injuries on a lien, then they are entitled to recover any monies expended on treating your injuries from the car accident. Depending on the lien, you typically must pay the bill back once your case has settled. However, you should consult with an attorney before agreeing to pay any outstanding liens.

Georgia Auto Insurance Minimum Requirements

There is no such thing as a “one size fits all” auto insurance policy—they come in all shapes and sizes, and drivers are free to tailor their policies to provide the coverage they want and need.

This does not mean that a driver can choose to forego auto insurance altogether, though. Georgia—like most states in the country—requires its drivers to carry a minimum amount of liability insurance to provide coverage to others if a driver causes an accident.

Bodily Injury Liability Coverage

An at-fault driver’s bodily injury liability insurance pays for expenses incurred by other people involved in the accident. It will not cover injuries sustained by the at-fault driver.

This coverage provides compensation for:

- Medical expenses, such as hospital bills and physical rehabilitation;

- Lost wages if you are unable to work after your accident; and

- Physical and emotional pain suffered during and after the accident.

In addition, if you cause an accident and are sued by the injured party or their insurance company, bodily injury liability insurance can cover your legal fees.

In Georgia, drivers must carry a minimum bodily injury liability insurance coverage of $25,000 per person and $50,000 per accident if more than one person is injured.

Example: Jake runs a red light and hits Sarah on her bicycle as she is legally biking through the intersection. Jake’s bodily injury liability coverage will pay for Sarah’s injuries up to the limits of Jake’s coverage. However, Jake’s bodily injury coverage will not cover his own injuries.

Property Damage Liability Coverage

Georgia drivers are also required to carry a minimum of $25,000 in property damage liability insurance. This coverage pays for damage that an at-fault driver causes to another person’s car or personal property.

Say, for example, that you cause a car accident that sends another person’s car into a fence located in someone’s front yard. Your own property damage liability coverage would help pay for the costs to repair both the car and the fence.

Example: Chris rear-ends Michael’s truck at a four-way stop, causing extensive damage to the truck’s tailgate and truck bed. The costs to repair Michael’s truck will be covered by Chris’s property damage liability policy up to the limits of Chris’s coverage.

Selecting Auto Insurance Coverage That’s Right for You

At The Millar Law Firm, we understand that choosing the right car insurance policy can be overwhelming. There are a lot of coverage options and add-ons to choose from, and the type of insurance coverage that you should choose depends on your individual wants and needs.

An auto insurance policy may be perfect for one person, but fall short for another driver. While you don’t have to get every type of coverage that an insurance carrier might offer, it’s important to select a coverage that sufficiently protects you and others if you are involved in a car accident.

Regardless of the coverage that you choose, there is one piece of advice that we can offer that doesn’t change: Choose a car insurance policy with limits that are higher than the minimum coverage limits. When picking a car insurance policy, you might be tempted to go with the least expensive option. But it’s important to remember that the state’s minimum requirements are meant to be exactly that: A minimum coverage that a driver must have by law.

We aren’t car insurance salesmen, and this isn’t a sales pitch—it’s a recommendation to ensure that your insurance policy sufficiently protects you and others in the event of an accident. A moderate or severe car accident can be exponentially higher than the minimum coverage limits that Georgia law requires, and if you select the cheapest insurance option, your coverage may fall short of the injuries and damages that are sustained in an accident.

Why Insurance Minimums Might Not Be Enough

As discussed above, Georgia drivers are required to carry a bare minimum bodily injury liability coverage of $25,000 per person and $50,000 per accident. In other words, if a driver who only has minimum insurance coverage causes an accident, the most that their insurance company will pay an injured party is $25,000. Likewise, if multiple people are injured in the accident, the driver’s minimum insurance coverage will top out at $50,000 for the entire accident.

In car accidents involving multiple people, minimum bodily injury liability coverage is quickly exhausted. Medical bills for injuries sustained in serious auto accidents can be tens—or even hundreds—of thousands of dollars.

No matter how much the victims’ injuries add up to, minimum bodily injury liability coverage will only pay out as high as the limits listed above. If the injured party’s losses are greater than these minimum amounts and the victim files a lawsuit against you, you could be on the hook for the remainder of the balance.

To protect yourself against potential liability, it’s always a good idea to purchase additional bodily injury liability coverage if you can. The amount of coverage you should get varies depending on your circumstances, but it’s generally a good idea to have liability insurance coverage that is equal to or greater than your total assets, including your home, car, savings, and any businesses you own.

Making a bodily injury claim

Usually, you or your car accident lawyer will make a claim with the at-fault driver’s insurance to cover your medical bills, lost earnings and pain and suffering. We recommend that you do not give a recorded statement to the insurance adjuster without first consulting an expert car accident lawyer. Bodily injury claims are normally settled with the at-fault carrier’s insurance adjuster after you have recovered from your injuries.

If your injuries are extensive or your medical bills high enough, your claim may have significant value. If the case equals or exceeds the limit of the at-fault driver’s insurance, you may also have a claim against your Underinsured or Uninsured motorist coverage. It is also essential to obtain the accident report from the police department as evidence when making any insurance claim.

Should I inform my own insurance company of my injuries?

You may inform your insurance company of your injuries, particularly if you must seek recovery under your auto insurance when the at-fault party’s insurance has been exhausted.

Property Damage Policies

As a reminder, property damage liability insurance will only cover costs to repair or replace the other vehicle in an accident that you caused—it will not pay for the costs to repair your own car.

If you want your insurance policy to cover repairs to your vehicle, there are two additional types of property damage policies that you can select.

Collision Coverage

Like its name suggests, this form of property insurance will provide coverage toward repairing or replacing your car in a collision. This is true even if the accident was your fault or if you were involved in a single-car accident, such as a rollover accident or a collision with a tree. Generally, if you lease your car or take out an auto loan to purchase it, you will be required to carry collision coverage.

Comprehensive Coverage

While car accidents are the main culprit of vehicle damage, your car can be damaged in other ways too. Comprehensive insurance covers damage to your vehicle that was not the result of a car accident. If your car was stolen, damaged in a storm, or vandalized, for example, comprehensive insurance would provide compensation to cover the repair or replacement of the vehicle.

Example: Kelly’s car was stolen from her apartment complex in the middle of the night. If Kelly’s auto insurance policy includes comprehensive coverage, Kelly’s insurance will pay for the cost of replacing her car up to Kelly’s comprehensive coverage limits.

As you can see, these two types of insurance coverage provide protection for different scenarios. Comprehensive and collision coverages are usually bundled together because one form of coverage may come into play and pay for your vehicle damage even if the other does not.

Uninsured and Underinsured Motorist Coverage

Although Georgia law requires drivers to carry minimum liability insurance coverage, drivers don’t always follow the rules.

Unfortunately, uninsured drivers are all too common in the state—in fact, around 12% of Georgia’s drivers are uninsured. And even if an at-fault driver is insured, their coverage limits may not be high enough to pay for the injuries and damages a victim sustains in an accident.

To provide an extra level of protection against accidents caused by an uninsured or underinsured driver, Georgia law requires auto insurance carriers to offer drivers a type of insurance called uninsured motorist/underinsured motorist (UM/UIM) coverage to protect people who are injured by these drivers. In fact, in order for a driver to opt out of this additional coverage, they must reject the coverage in writing.

Uninsured Motorist (UM) Coverage

When a person is injured in a car accident caused by another person, the at-fault driver’s insurance company is responsible for providing compensation for damages and injuries sustained to the innocent party. If an at-fault driver doesn’t have car insurance, though, the injured victim can’t look to the driver’s insurance carrier to cover the costs of his or her injuries.

To provide protection in case a person is injured in an accident caused by an uninsured motorist, drivers can add uninsured motorist coverage to their own auto insurance policy. If you purchase this coverage, your own insurance company will step in and provide you with compensation if you suffered injuries in an auto accident caused by an uninsured driver.

Example: Ralph was sideswiped on the interstate by a person who didn’t have auto insurance. If Ralph’s insurance policy includes uninsured motorist coverage, his own insurance will pay for his injuries and vehicle damage because Ralph can’t get compensation from the other driver’s insurance company.

Uninsured motorist coverage also comes into play if you are injured in a hit-and-run accident and can’t determine the identity of the driver. Since you can’t seek compensation from a driver’s insurance carrier if you don’t know who the driver is, your own uninsured motorist coverage will compensate you for your losses.

Example: An unidentified driver pulled out in front of Samantha on Main Street, clipping her car. Instead of pulling over, the driver fled and, unfortunately, Samantha didn’t get a good look at the car or license plate. Samantha’s uninsured motorist coverage will pay for her injuries and the repair to her vehicle since she doesn’t know who hit her and can’t collect from their insurance policy.

Underinsured Motorist (UIM) Coverage

Georgia’s minimum coverage requirements for car insurance are meant to provide some level of protection to those who travel the state’s roads. Unfortunately, accidents and the injuries that result from them often cost far more than the minimum coverage limits required. Once an at-fault driver’s policy limits have been exhausted, the injured party could be on the hook for the remainder of the expenses.

This is where underinsured motorist coverage enters the picture: It’s a form of coverage in your own auto insurance policy that steps in and covers your losses if you’re involved in an accident that costs more than the at-fault driver’s policy limits.

Example: Diana was involved in a serious accident caused by Kent. Kent is found to be at fault for the accident, but only had the minimum liability coverage that Georgia requires. Diana’s $100,000 car was totaled, and her medical bills were far more than the $25,000 limit on Kent’s bodily injury liability coverage. If Diana has underinsured motorist coverage in her auto accident policy, her medical bills and the costs to replace her vehicle will be covered up to her coverage limit.

What is uninsured motorist coverage? And what is Med-Pay?

Uninsured motorist insurance is optional coverage that you may have on your own auto insurance policy. This additional insurance kicks in if the at-fault party lacks liability insurance. It is recoverable only when the owner or operator of an uninsured motor vehicle is determined to be at fault legally.

Add-On Auto Coverage Options

While we’ve explained the most important types of coverage in auto insurance policies, these aren’t the only types of coverage that you can get. Additional forms of auto insurance coverage are available to drivers who wish to protect themselves even more in the event of an accident.

These coverage types aren’t necessarily needed, but can provide compensation in the event of an accident. Optional coverage types include:

- Guaranteed auto protection (GAP): Insurance carriers will only pay for repair or replacement of your car up to its current value. Unfortunately, the minute you drive a new car off the lot, it begins to depreciate. If you are involved in an accident that results in serious damage to your vehicle, your insurance coverage may not even be as high as the loan you have on your car. This is where gap insurance comes in—it pays the difference between what your car is worth and what you still owe on the car.

- Roadside assistance: The inconveniences that can come with car ownership extend beyond accidents. If you have roadside assistance coverage, your insurance will pay for the costs of towing an inoperable car, running out of gas, or locking yourself out of your car.

- Rental reimbursement: Vehicle repairs are an inevitable part of auto accidents. Unfortunately, cars can’t always be fixed overnight. If you are involved in an accident, you may find yourself without a car for days or even weeks. Rental reimbursement coverage does exactly what it sounds like—it provides compensation for the expenses of renting a car while waiting for your car to be repaired.

1201 West Peachtree Street #2339 Atlanta, GA 30309+1-770-212-3795$0-$100000

1201 West Peachtree Street #2339 Atlanta, GA 30309+1-770-212-3795$0-$100000Great car accident attorneys! Easy experience.

How to Get Your Car Fixed or Totaled After an Accident

If your car or truck was damaged, but can be repaired you may be entitled to receive a rental car and to recover a payment for the diminished value of your vehicle following the wreck.

Getting a rental vehicle after your wreck. We recommend that you contact the at-fault driver’s insurance company to report the claim and request a rental car. You are entitled to a rental that is similar to your own vehicle. At the time you report the accident, you may receive instructions or authorization to rent a car by the at-fault driver’s insurer. However, if the adjuster tells you that they are still “investigating” and cannot yet authorize a rental, you may go through your own insurance company, up to the limits of your coverage. Generally, speaking you are entitled to a rental vehicle until your own car or truck is repaired or your personal coverage is exhausted.

Getting your vehicle repaired. First, you should contact the at-fault driver’s insurance company. The insurer may recommend a repair shop, but you are entitled to choose your own shop. Next, a repair estimate will be prepared. If you use your own shop, the at-fault driver’s insurance company will have to approve the estimate. We recommend that you request that your car be repaired using only original, new, parts. However, by law an insurance company can refuse to cover original parts if comparable aftermarket parts are available.

What if your vehicle is a total loss? If the insurance company declares that the cost to repair the vehicle exceeds its value, it may be declared a total loss. In this case, the at-fault insurance company is required to pay the fair market value of the vehicle. This can be subjective, depending on the age, condition, and options on the car or truck. Usually, the fair market value is negotiable. A good guide or rule of thumb is what private individuals are selling comparable vehicles on the market, such as in AutoTrader, Cars.com or the Blue Book.

Are you entitled to payment for damaged items and property in your car? Yes, you can be reimbursed for items damaged inside the car in the wreck. You will have to prove that the items were damaged and establish the value of these things. You may use receipts, photographs, or repair bills to recover these losses.