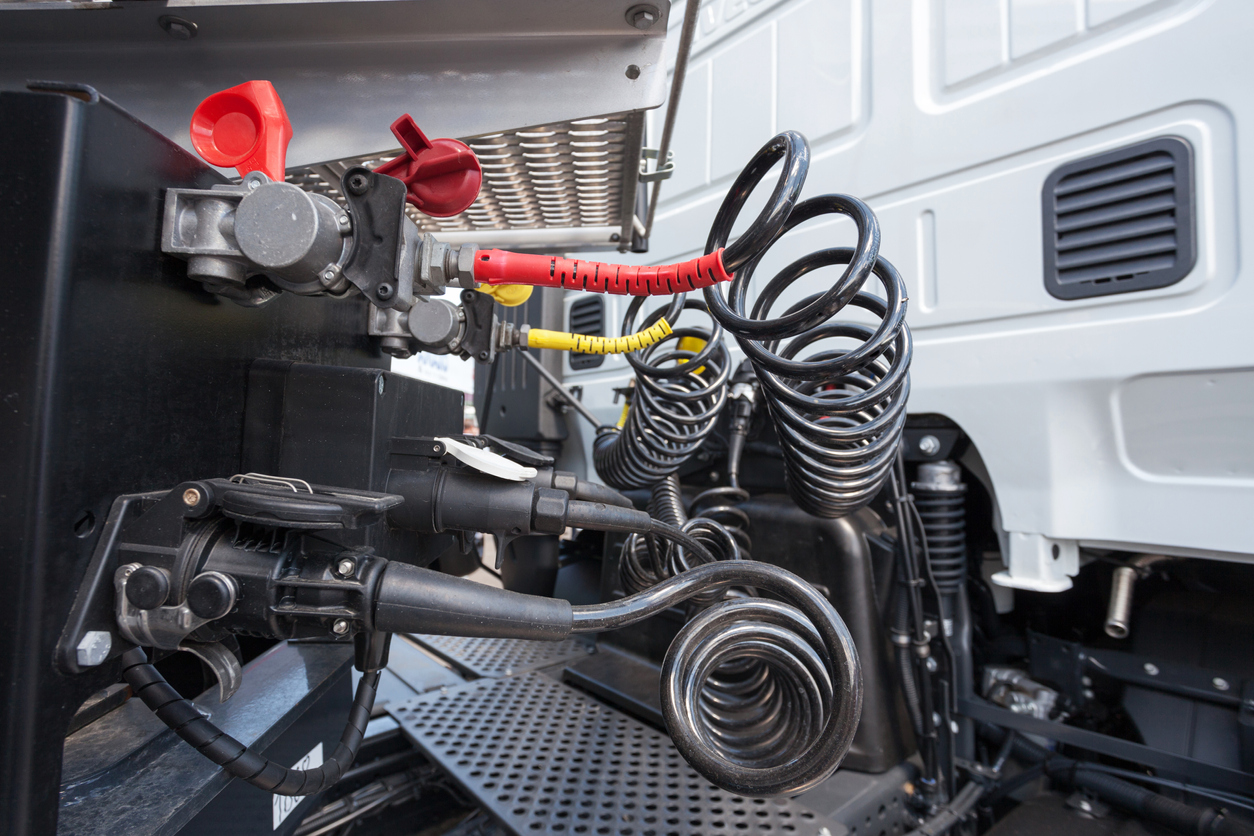

Key Points: Truck accidents have the potential to lead to significant payouts due to the severe damage they can inflict and the higher available insurance coverage that most trucks carry. Although it might seem appealing to obtain cash from a truck accident, the reality is quite harsh. No one truly wants to benefit financially from […]